Claiming with Loop

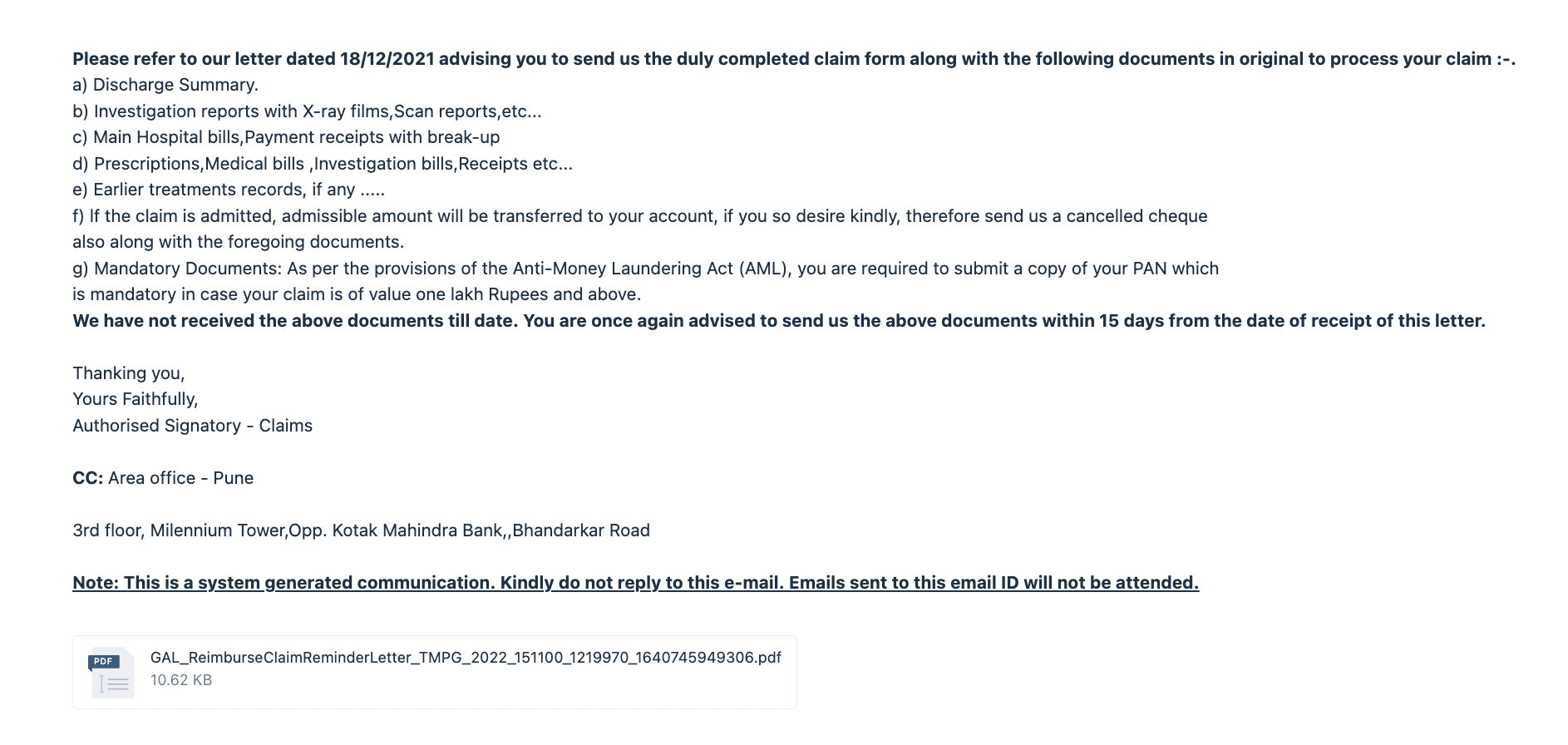

“It’s been 20 days since I claimed, I still don’t have my money!

Every time I call - you ask me for new documents, can’t you tell me everything at once?”

~ Vipul, a loop customer

Top Insights

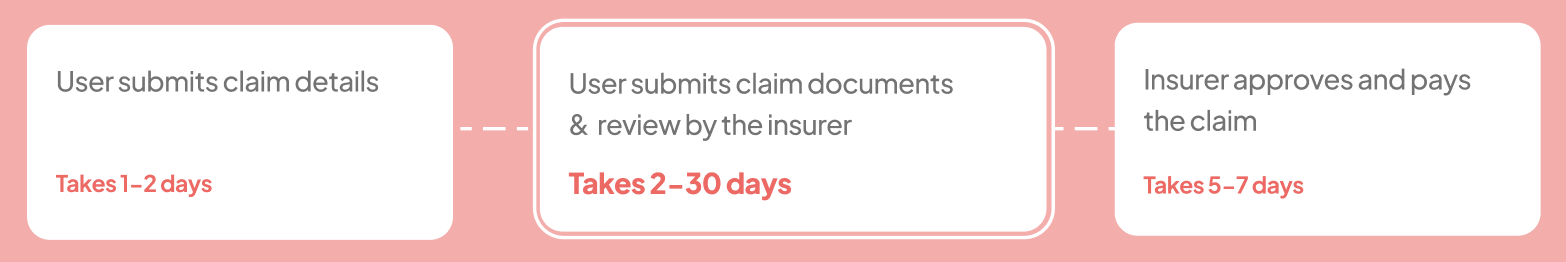

Upon analysing 270 customer support tickets we realised -

- 90% claims had issues with documents for which insurers raised queries. The top documents for which queries were raised were -

- Bank document - 35%

- Indoor case papers - 21%

- Attestation not done on documents - 15%

- USG Lab reports - 15%

- 40% cases were delays by the insurer

270 customer support tickets

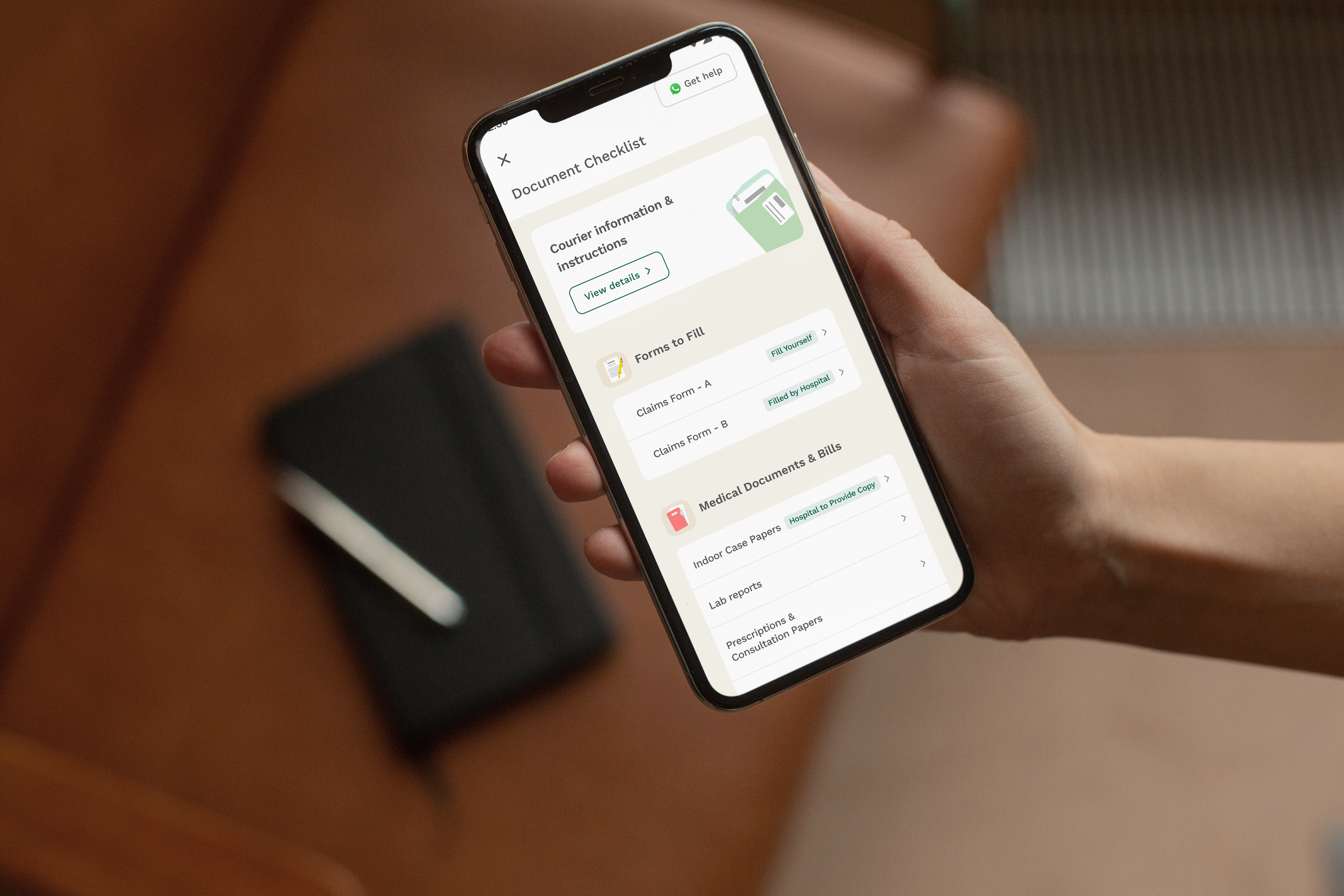

The quick solve

Since this was a burning problem, we came up with a quick solve -

We created an interactive document checklist that includes:

- Mandatory documents

- Additional documents based on your treatment

- Samples and guidelines for each document

From the hospital visit

Your Documents

Case Specific Documents (if applicable)

All the documents listed are mandatory

These documents are mandatory only if you fall under any case below

Missing any of your documents could lead to a deduction or denial of your claim

Document List

For any queries, call at 080-3783-6789

Click on the category to view the documents required

- Copy of PAN Card of Employee

- Cancelled Cheque of Employee with Printed Name

OR

Bank statement/ Photocopy of first page of passbook

- Copy of Aadhar Card (Both Patient and Employee)

OR

Birth Certificate (in case of a baby)

- Claims Form (Part A)

OR

Summary of Expenses (if mentioned in email)

- Prescriptions

- Lab Reports

- Paid Receipts matching Final Bill Amount

- Pharmacy Bills

- Hospital Bill with Breakups

- Indoor Case Papers (with Doctor’s Notes, TPR Chart & Nursing Sheet)

- Discharge Summary OR Daycare Summary OR Death Summary

- Claims Form (Part B)

OR

. Summary of Expenses (if mentioned in email)

Death Case

Chemotherapy/Radiotherapy

Angioplasty

Angiography

Hernia

Abortion

Accident

Orthopaedic case

Cataract

Surgery

Maternity

Viral Infections/ Fever/ Malaria/ Dengue/ Typhoid etc

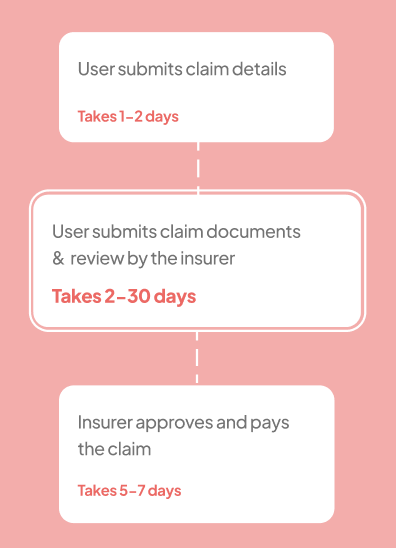

But, was it working?

No, because -

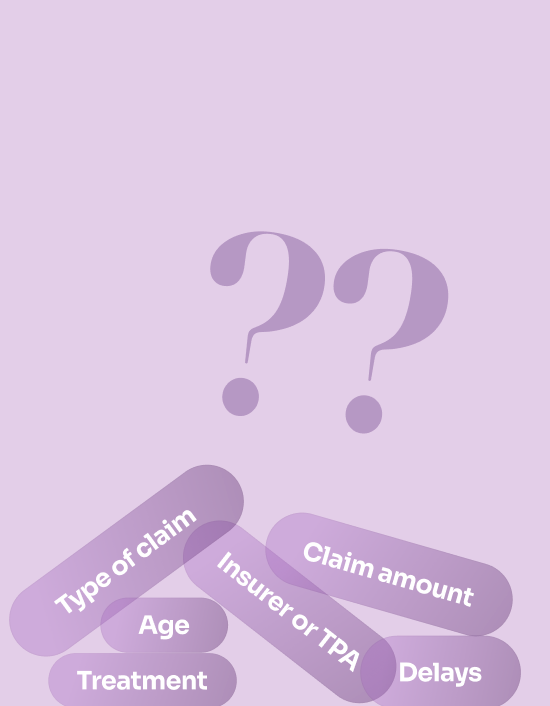

- Document requirements varied based on 7 factors (e.g., insurer, treatment, claim type), making it complex.

- The PDF guide was over 100+ pages and not tailored to the user's case—making navigation difficult.

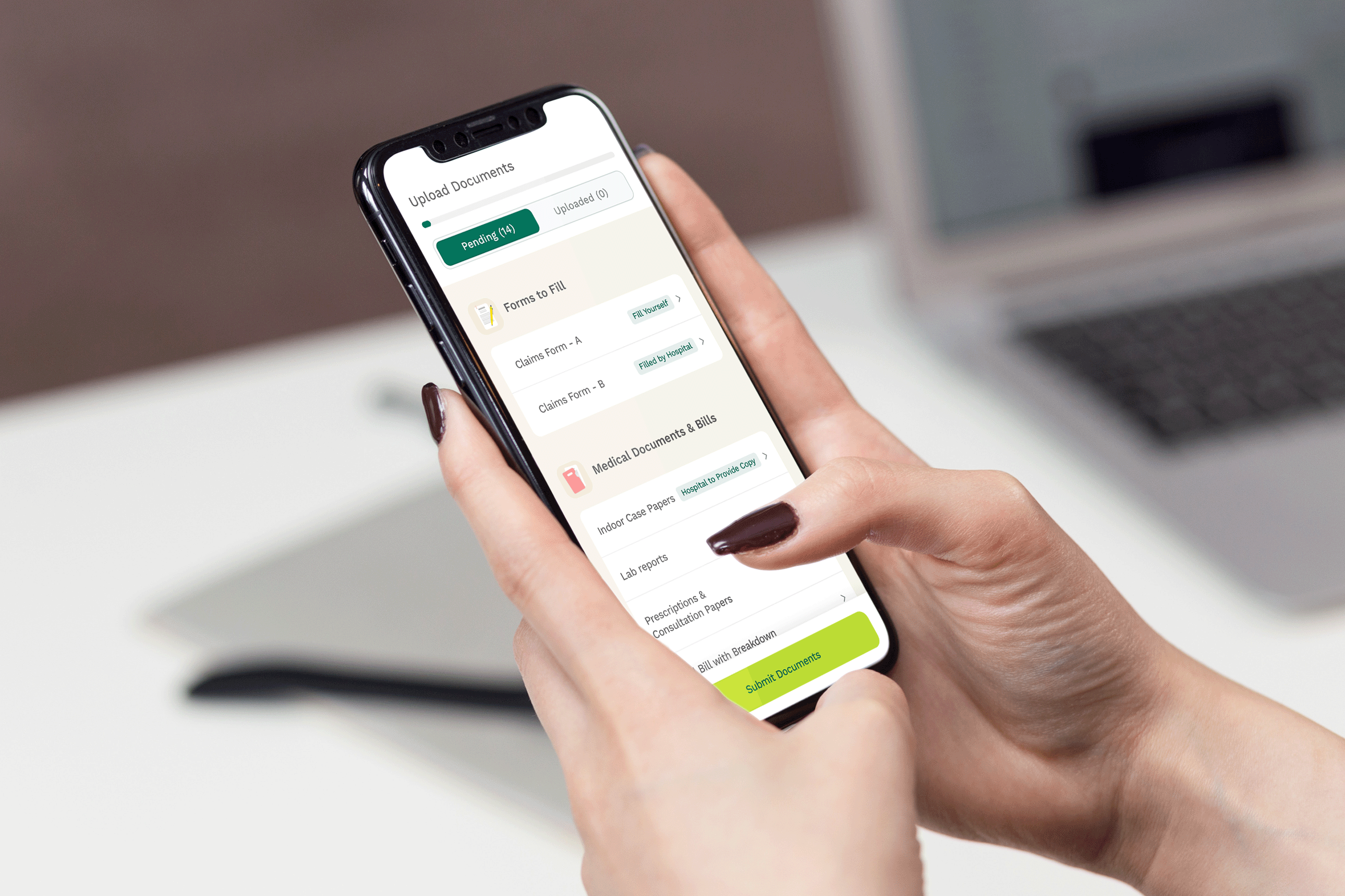

- Tracking pending documents was difficult—users have to submit 14-16 documents (avg)

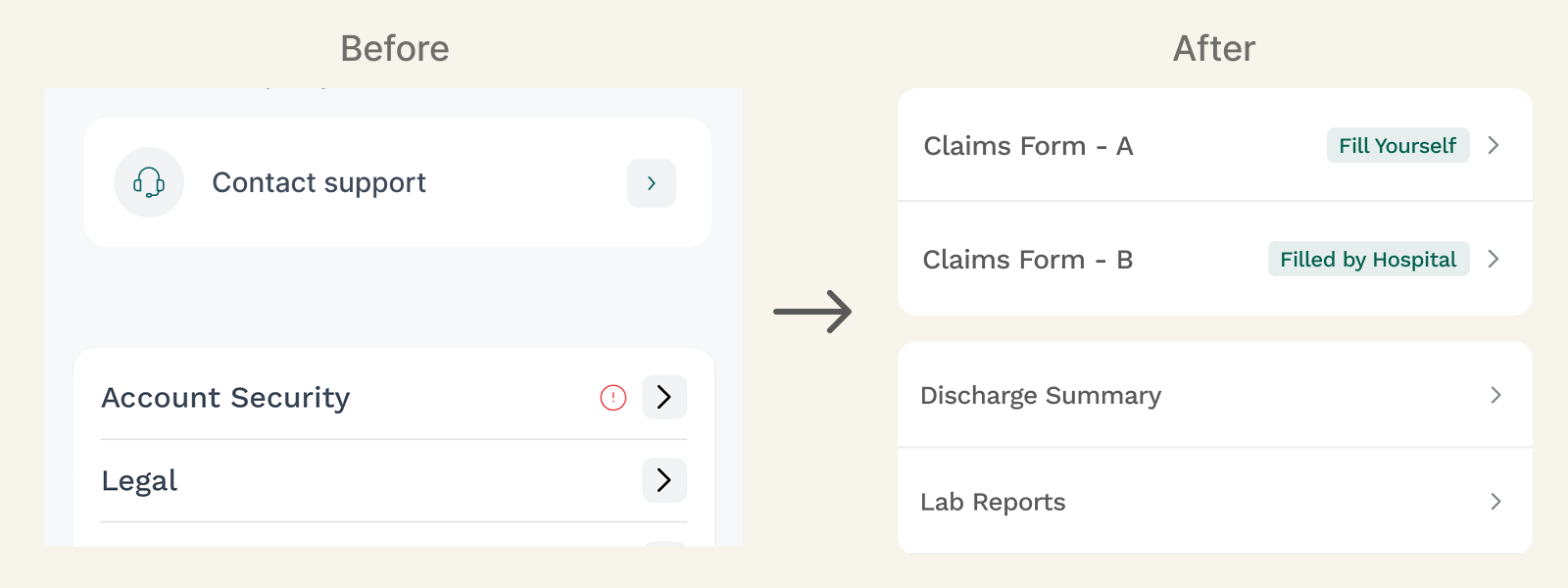

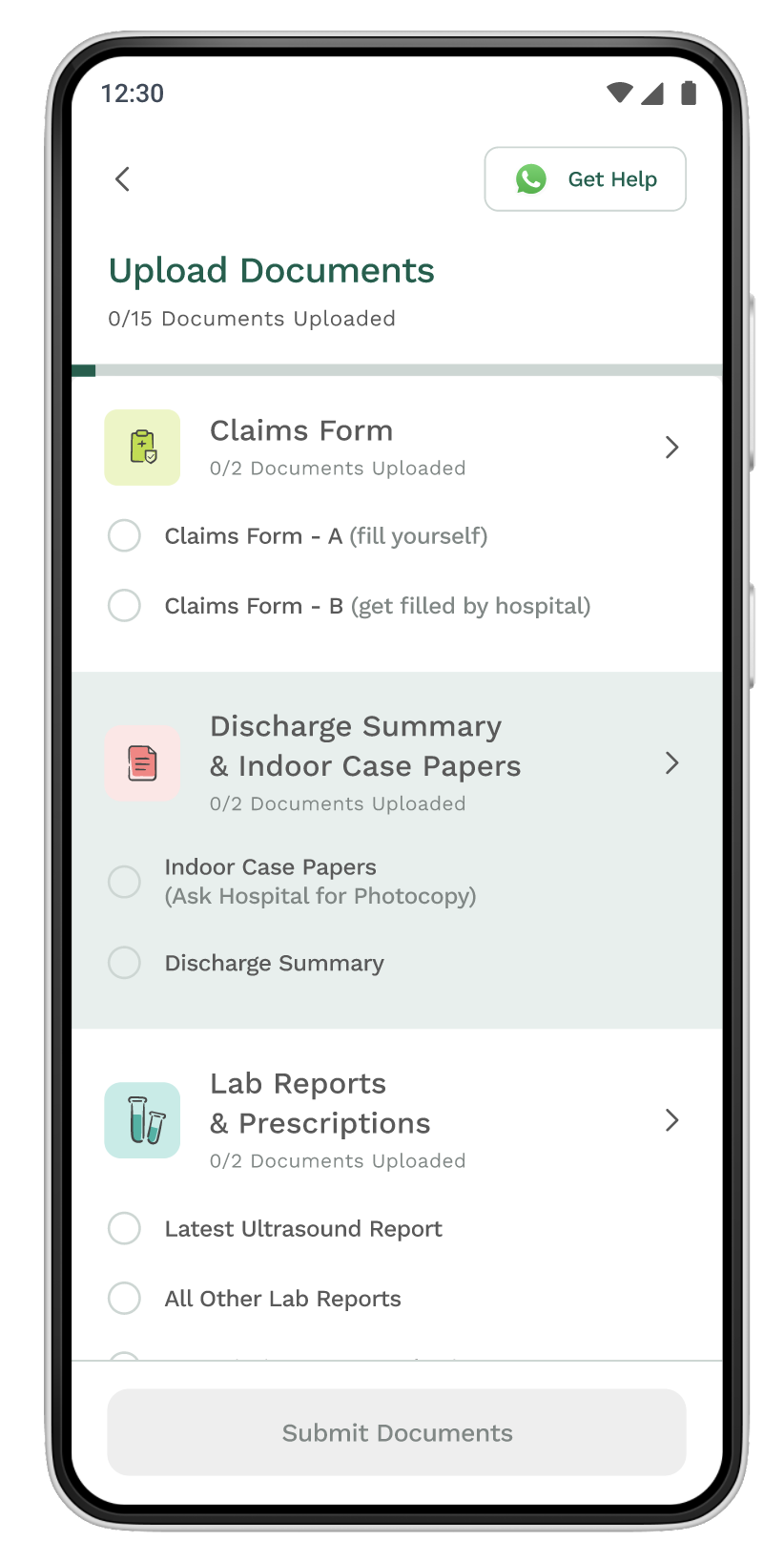

CONCEPT A - The guided tour

Documents were grouped into categories to reduce overwhelm by showing only one group at a time and guiding users step by step.

What did users think of it?

- Users liked the clean and minimal UI, but wanted to know upfront which documents are needed

“It says 3 documents — but what are those 3 documents?”

- Tracking documents with the counters was difficult

“The tag says 1/2 have been uploaded, I wouldn’t know which one is done and what’s remaining.”

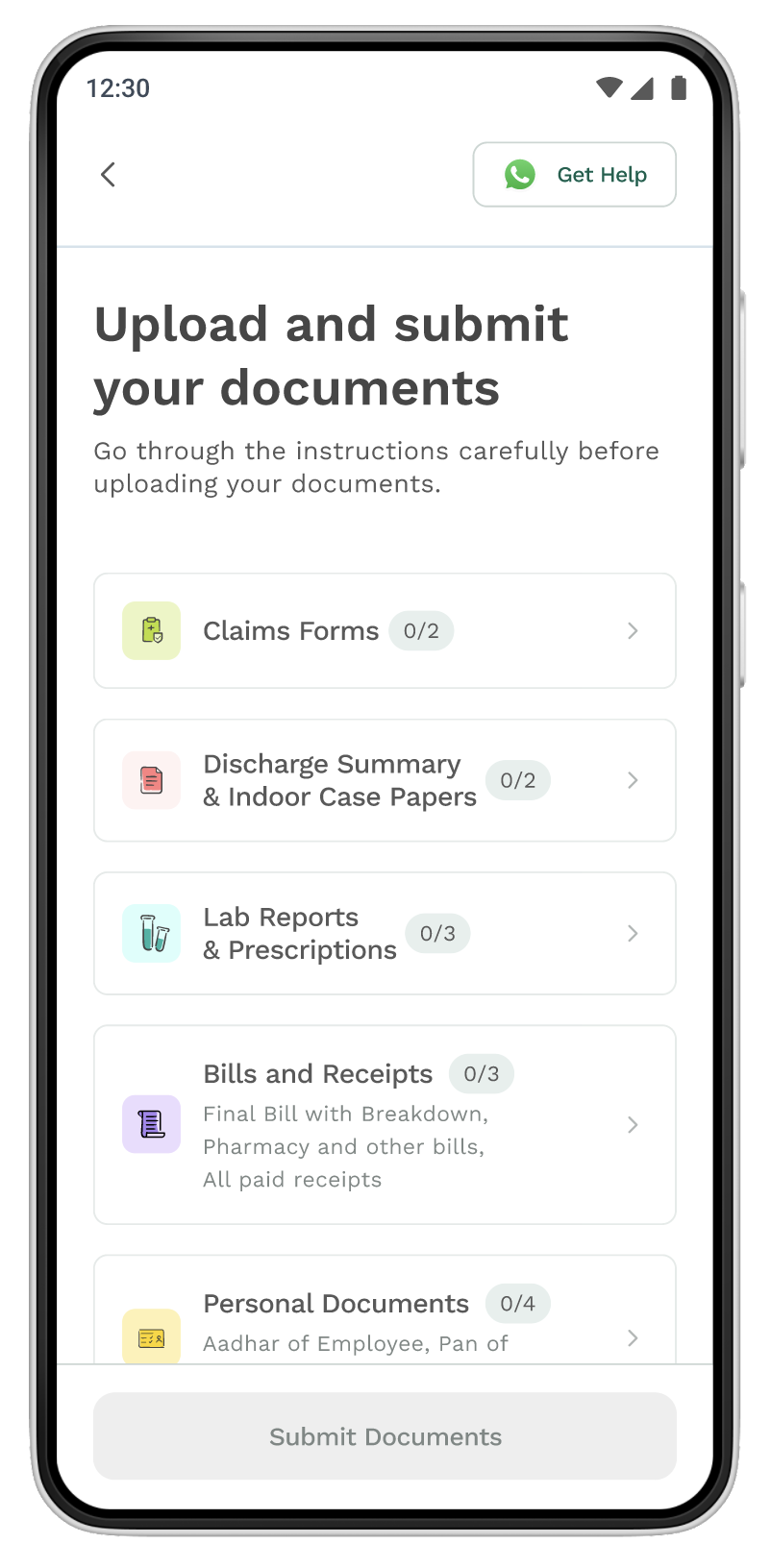

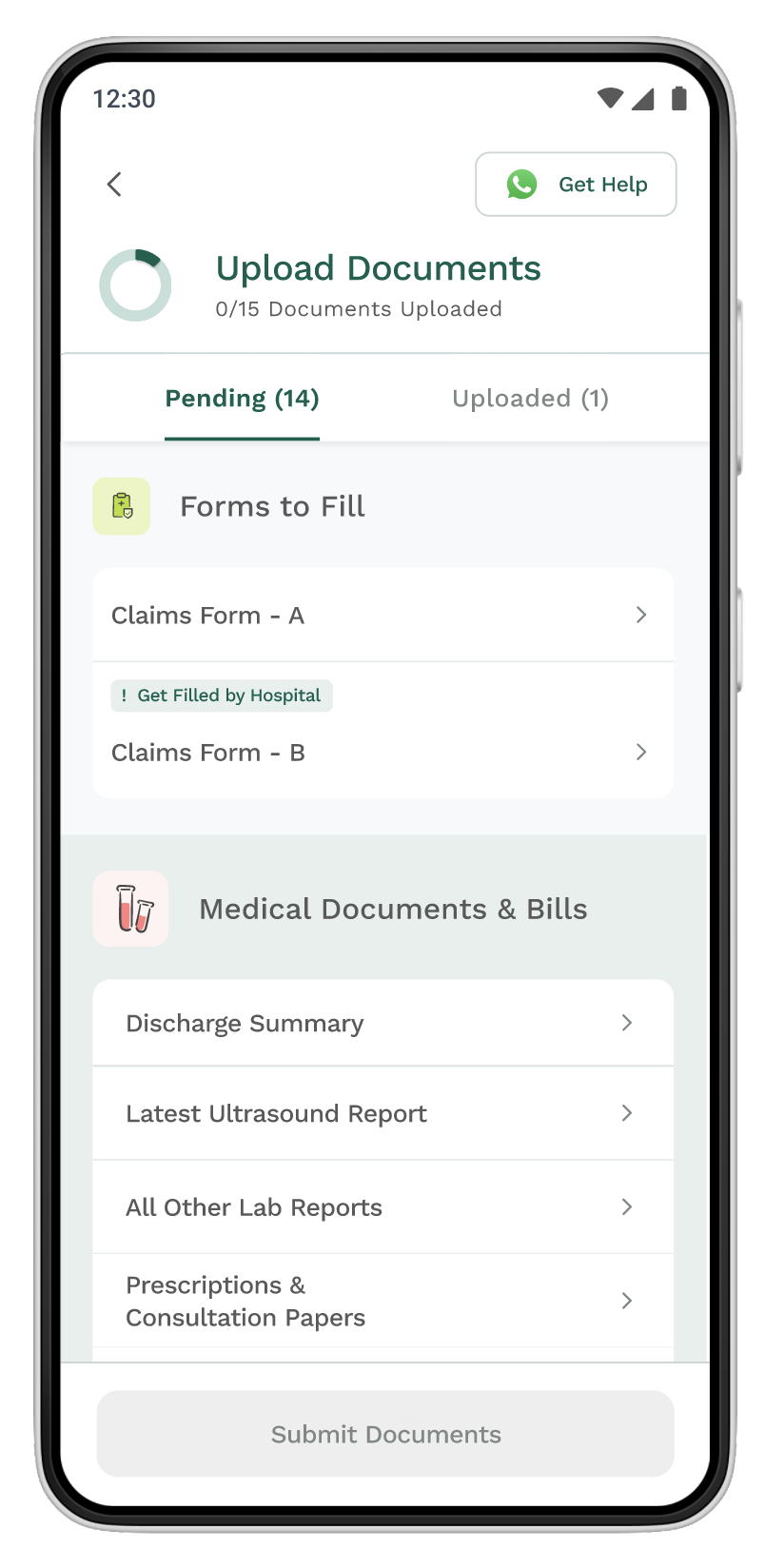

CONCEPT B - The checklist

This approach worked like a to-do list. All required documents were visible upfront within each category, and items got checked off automatically as users submitted them.

What did users think of it?

- Liked seeing all documents upfront

“I can see everything in one go. I don’t have to double click.”

- Found tracking easier with checkmarks and progress bar

“The bar gives me an overview, the ticks give me detail.”

CONCEPT C - Clear as you go

This design helped users stay focused by showing only what’s pending.As soon as a document was uploaded, it automatically moved out of the list.

What did users think of it?

- Liked seeing all required documents upfront

“I can see everything in one go. I don’t have to double click.”

- Found tracking easier with both bar and checkmarks

“Bar gives me an overview, the ticks give me detail.”

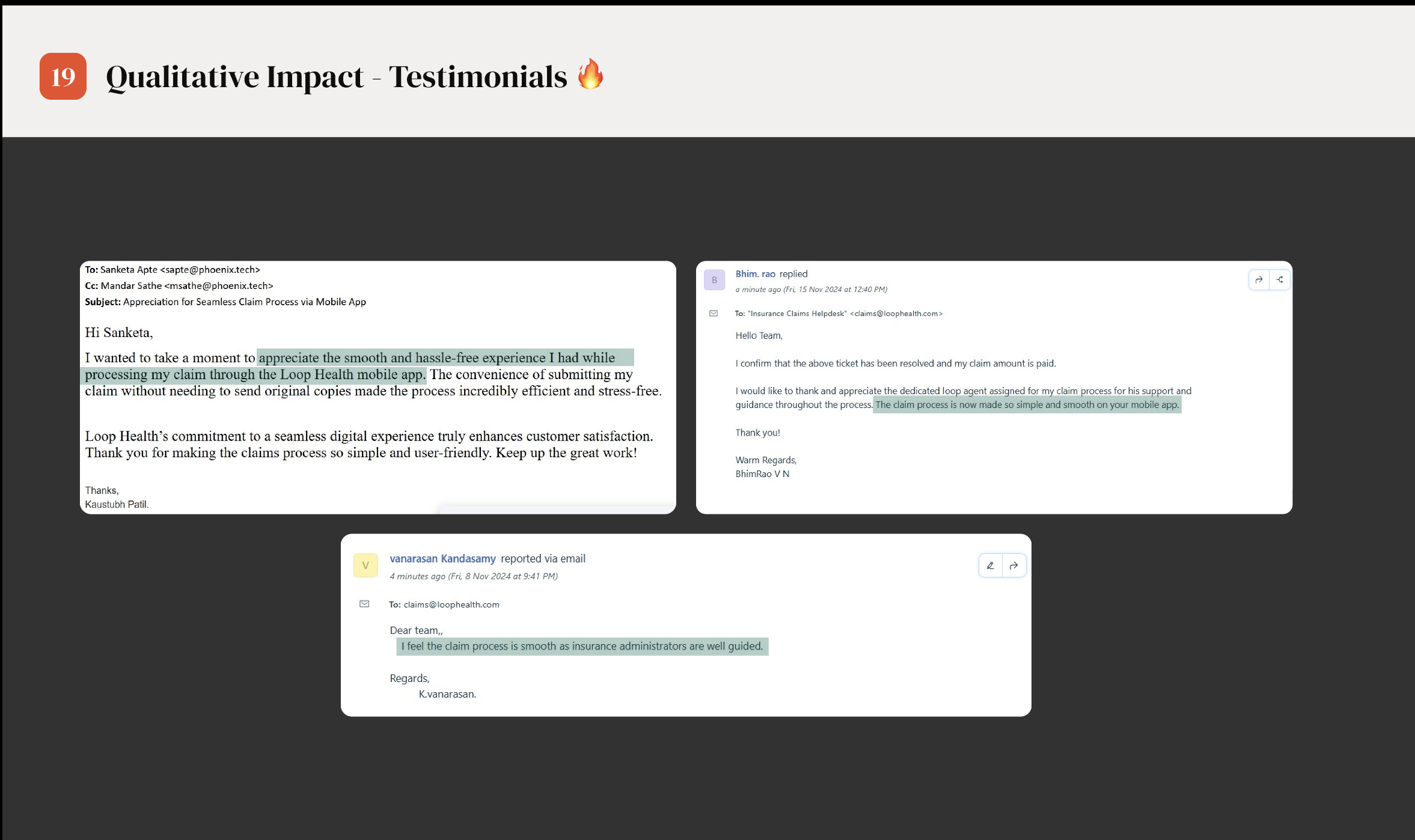

Challenge overcome: Stakeholders favored Concept A for its “clean” look and weren’t sold on Concept C. It took strong articulation and user testing to shift their view — once they saw real user quotes, their confidence grew. A hard-won battle! 🔥