Claim Status Tracking

“Can someone tell me what is actually going on with my claim? I get the same response again and again”

~ Neha, a loop customer

Claim will be resolved on 11 July, 24

On Time

12:22

Raise a Claim

Get Help

Current Status :

Insurer’s medical team is reviewing the documents

24th July, 24 :

Insurer has received the documents

View Detailed Timeline

TIMELINE:

Claim Registration

Completed on 05 Jul’ 24

Document Submission

Completed on 06 Jul’ 24

Review by Loop

Completed on 08 Jul’ 24

Review by Insurer

Expected date : 12 Jul’ 24

Documents received by insurer

Documents reviewed by medical team

Payment Complete

Expected date : 13 Jul’ 24

Show More

12:22

Raise a Claim

Get Help

#64846

Claim Tracking ID

On Time

Current Status :

Loop is submitting the documents to your insurer

Estimated Claim Payment Date :

24th Feb, 2023

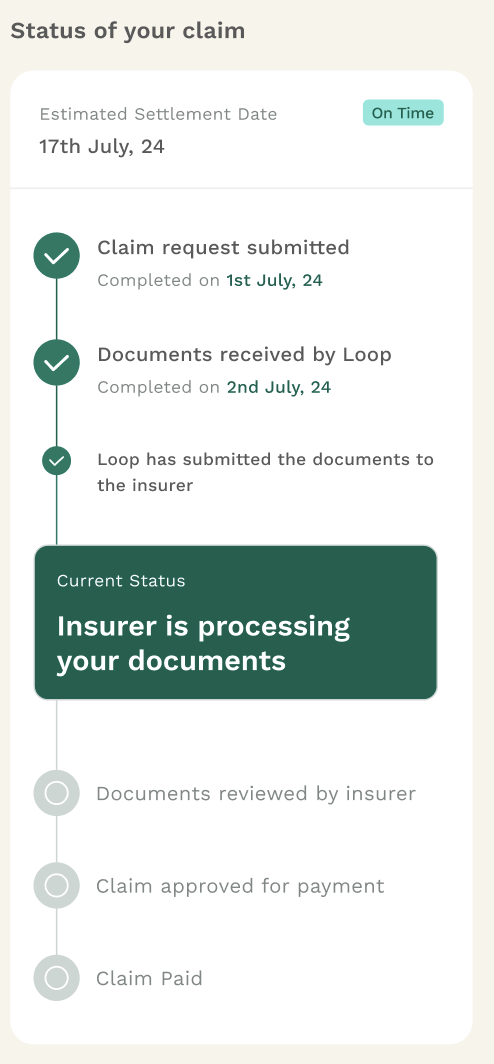

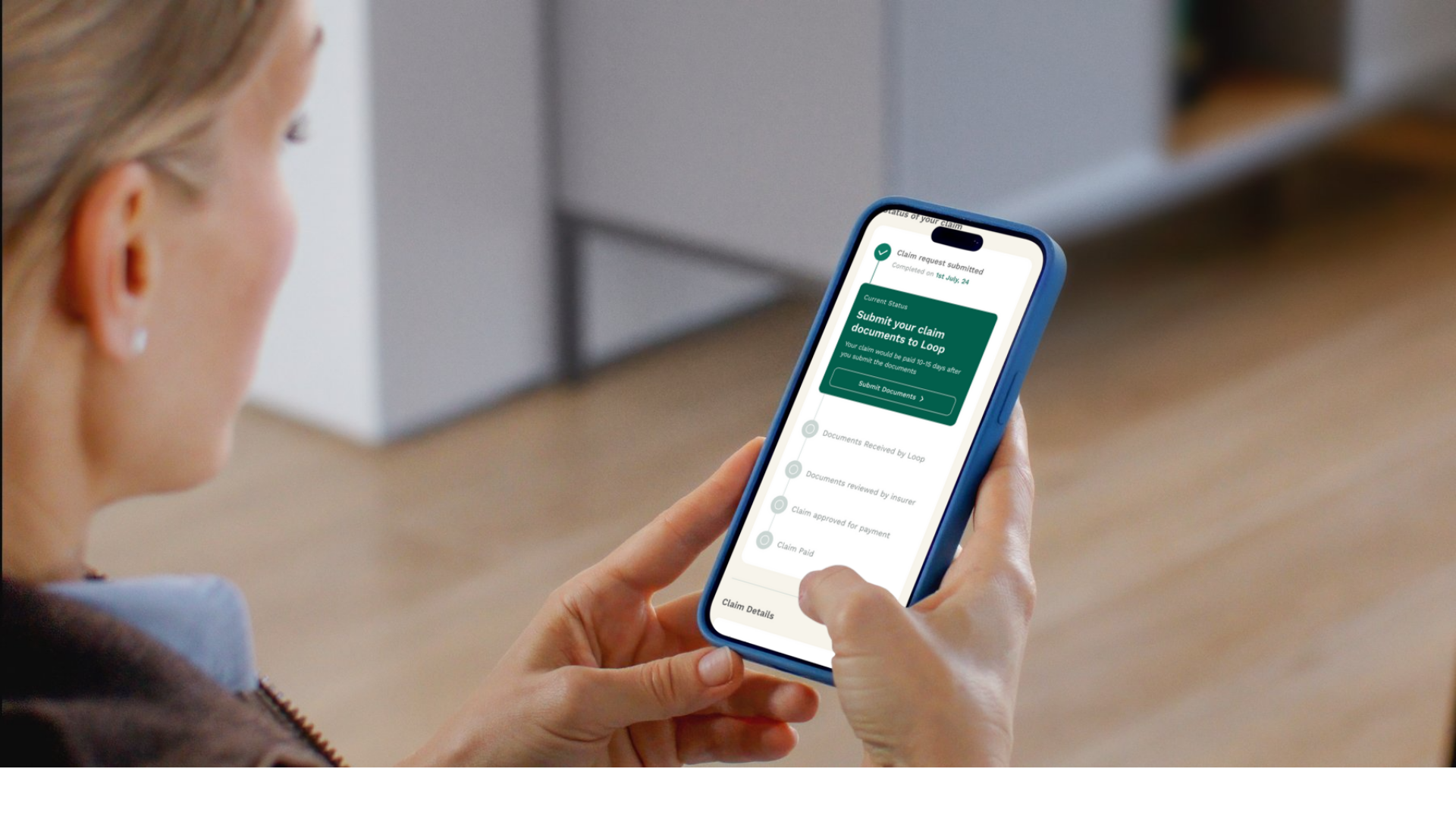

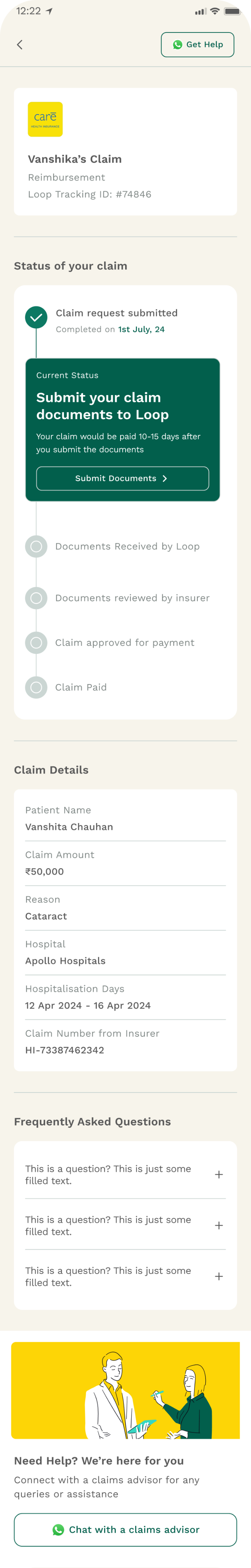

Status of your claim

Claim registered

Completed on 1st July, 24

Documents Submitted

Completed on 3rd July, 24

Loop is submitting the documents to your insurer

Takes 1-2 Days.

Claim submitted to insurer

Documents review by insurer

Takes 7-10 Days.

Claim approval

Claim payment

Takes 3-4 Days.

Claim Details

Patient Name

Anoop Agarwal

Claim Amount

₹50,000

Reason

Cataract

Hospital

Apollo Hospitals

Hospitalisation Days

12 Apr 2024 - 16 Apr 2024

Previously submitted documents

FAQs

Need Help?

Reach out instantly to Loop about any claim questions

Chat with your agent

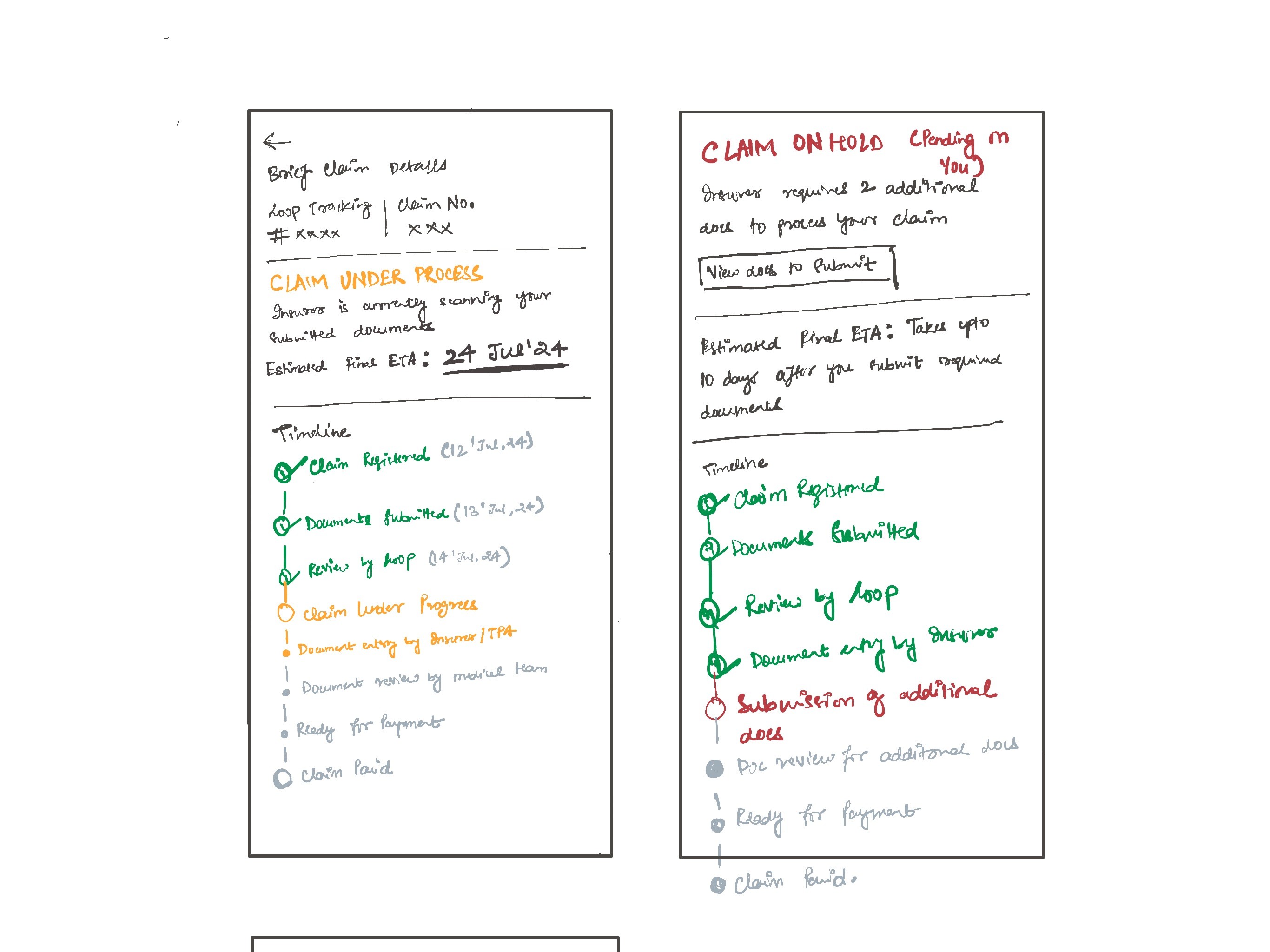

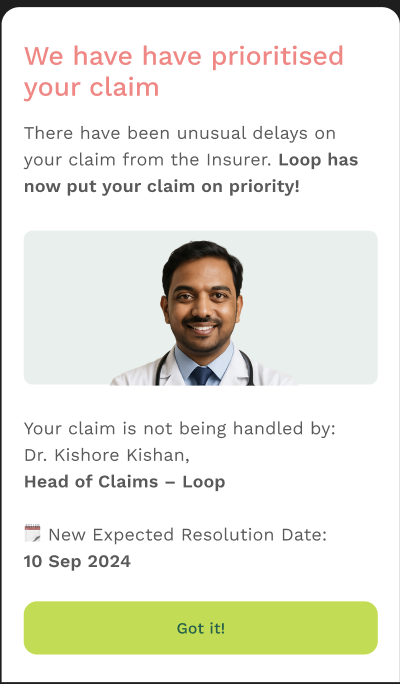

Final solution

Final solution (key components)

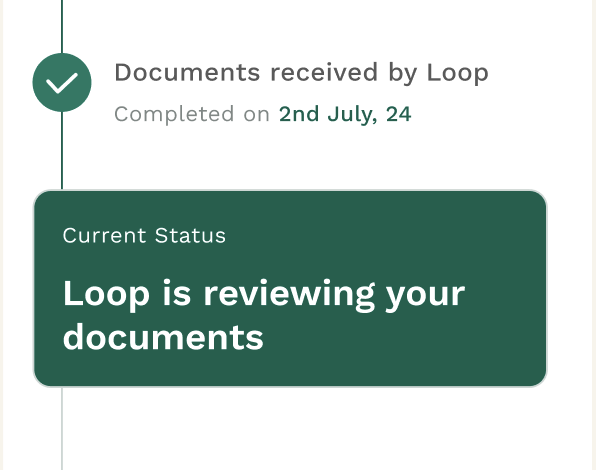

1. Timeline with Clarity and Momentum

A structured claim timeline that not only shows each stage but also:

- Clearly highlights where the claim is right now

- Shows ETAs for each upcoming step, including estimated payout

- Shows sub status of claims to create a sense of progress, especially important when claim stage remains the same for a few days